Says the BBC:

The Tories took councils from Labour and the Lib Dems including Derbyshire, run by Labour since 1981.I understand there are certain peculiarities in British politics at the moment. Nonetheless, the poor results for Labour are no doubt partly due to the fact that the economy has gone hang-gliding without a glider on Labour's watch. And it kind of points up one of the absurdities of representative democracy: utterly contingent factors play an enormous role in the outcome of elections. For instance, the Great Depression traumatized countries around the world. In the US, the response was to elect Franklin Roosevelt and the most liberal government in US history. In Germany, the response to elect Adolf Hitler and the Nazis. In both countries, the economy eventually improved; and in both countries, the new government got the credit. Likewise, the tanking economy didn't help the Republicans in the US last fall, and it's not helping Labour in the UK now. But all of this is quite aside from who's actually responsible for the tanked economy.

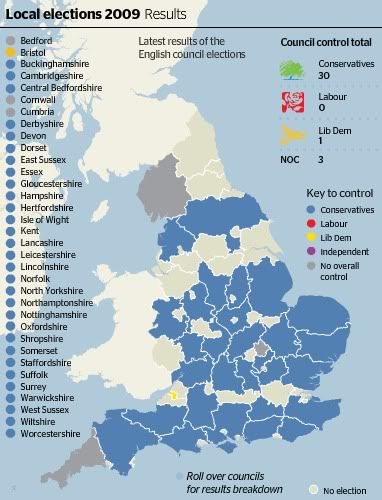

The Lib Dems won control in Bristol while Labour lost control of all of its four councils.

Labour deputy Harriet Harman admitted the results were "disappointing" but said the party would learn from them.

The Conservatives took Staffordshire, Lancashire, Derbyshire and Nottinghamshire from Labour - which had run all of them for more than 25 years - as well as Devon and Somerset from the Lib Dems...

With all the results in from the 34 councils which held elections, the Tories gained 233 councillors while Labour lost 273 seats and the Lib Dems four - although Sussex's results are provisional pending a recount in one ward.

According to the BBC's projections, the Conservatives garnered 38% of the national vote with Labour falling to a historic low of 23%.

The Lib Dems polled an estimated 28% of the vote, with other parties on 11%.

19 comments:

You could argue (and I would) that the policies of Gordon Brown & the Bush/Reagan/US right-wing, respectively, played a huge part in building up the credit/housing bubble and the subsequent denouement. Economically, a Blair Labourite is only a few degrees removed from Thatcher & Reagan-style conservatism (as was/is a Clinton Democrat).

I agree with both of you to some extent, but it's important to remember that capitalism suffers from economic cycles. Recessions are pretty much guaranteed from time to time; there is little any government can do about it. I think the economic policies of Clinton followed by those of Bush in the US, as well as those of Blair in the UK served to put off the inevitable downturn. Putting it off may also have made it worse.

To maintain the concept of a cyclical economy, it is generally some technological innovation that ends the down cycle (widespread adoption of the automobile, the PC, the internet). The question is, what technology will break us out of this recession, and can government play a role in facilitating it?

Having scrolled down to the post on the broader European elections, the rejection of incumbents supports the position that whoever is in charge when the economy tanks is going to lose elections. Maybe the pirate party will save us all - file sharing and a next generation internet as the technology that will end the global economic downturn.

Governing parties are not being punished across the board. As the post on European elections notes, governing center-right parties in France and Germany have not been blamed for the recession. The Republican party in the US does in fact bear a lot of blame for the crisis, as does the UK labor party, though both parties were suffering for their governing failures long before the financial crisis. Recall that the collapse of the Republican party began in the 2006 Congressional elections.

Who's responsible for the economy generally, tanked or tigered? We are. More particularly, people who do things like buy major material goods like houses & cars, services like insurance, accountancy, & whatnot, and whose line of work ties them into those purchases more & more. As was said plenty last year: its the people who took out those dodgy mortgages as much as the people who offered them.

David - To some extent that's true. But if you're saying people who took out dodgy mortgages are primarily responsible for the bursting of the housing bubble, I really can't go along with that. I mean, you expect people to have a certain degree of financial literacy - to be able to balance their checkbooks, for example. But if the bank is offering you a mortgage, and most of the financial experts in the country are telling you to invest in rising real estate prices, and the financial sector of the economy itself is betting on rising home values and essentially giving their backing to those mortgages by investing a ton of Wall St. wealth there, how is it reasonable to expect a lowly home-buyer to have better judgment than all of these enormous financial institutions? Of course in retrospect, the whole thing looks like a giant ponzi scheme. (And actually, I've seen high finance as basically that for years now, but that was always based on my intuitions and generally pessimistic nature (though note that "realistic" is the word pessimists use to describe themselves) rather than my understanding of the particulars of finance.) You can't expect someone who just wants a nice house in the 'burbs to have greater financial acumen than the guys who run AIG or Morgan Stanley or whatever.

The real problem is that the financial system just got to be (and still is) too complex and, arguably, too divorced from the actual production of goods. And even the captains of finance apparently lost track of what was really going on. You solve that problem by regulation, not by expecting Joe Schmoe to understand the ins and outs of leveraged derivatives transactions.

Richard - I pretty much agree with you there. But just note that if Kerry had beaten Bush in 2004, the housing bubble still would have inflated and burst, and the Democratic Party would almost certainly have taken the blame rather than the Republicans. And John McCain would be president now, trying to fight the recession by cutting spending and starting a war with Russia or whatever.

Alurin - Yeah, the results in France and Germany are interesting. But if, like me, you think Brown's government has done a lot better job at fighting the recession than, e.g., Merkel's, this just reinforces the absurdity of such electoral outcomes.

1. We'll see; it seemes that the orthodox view is that Brown is handling the recession/depression better than Merkel, but really, it'll take more than 50 years before we'll really know for sure who's policies were better.

2. Expect ordinary folk to have better judgement than enormous financial institutions? No. Expect them to have better judgement? Yes. In other words, just because almost all investment bankers were greedy, myopic SOBs who levered too much and didn't prepare for the worst doesn't absolve Joe Blow for doing the same.

I think people fear idea management and innovation because there's a significant number of ideas that simply won't plan out.......Nice statement.....keep posting

this day I've been searching for information on various issues, this I found very good and I would like to congratulate you for your work.

I think that this post is one of the best that i have read in my life, congrats you did a great job,.

the difference between the content spammers and most corporate innovators is that the smaller

I'm writing to you because I just came across a business that I think has great potential. It lets you save money on almost everything. Make money from almost everything,

If growth is important to a firm, and if growth is dependent on offering existing products and services to new customers

innovation is very natural and happens in the "real world" as new plants and animals colonize new ecological niches.

I wonder how you got so good. This is really a fascinating blog, lots of stuff that I can get into. One thing I just want to say is that your Blog is so perfect

We generally think most specifically about the risk associated with a new product introduction

I would be aware that as somebody who really doesn’t comment to blogs a lot (in actual fact, this may be my first put up), I don’t think the time period “lurker” is very flattering to a non-posting reader.

Congrats you did a great job

Post a Comment